Reliable Protection For Every Transaction

Building Confidence In Every Transfer

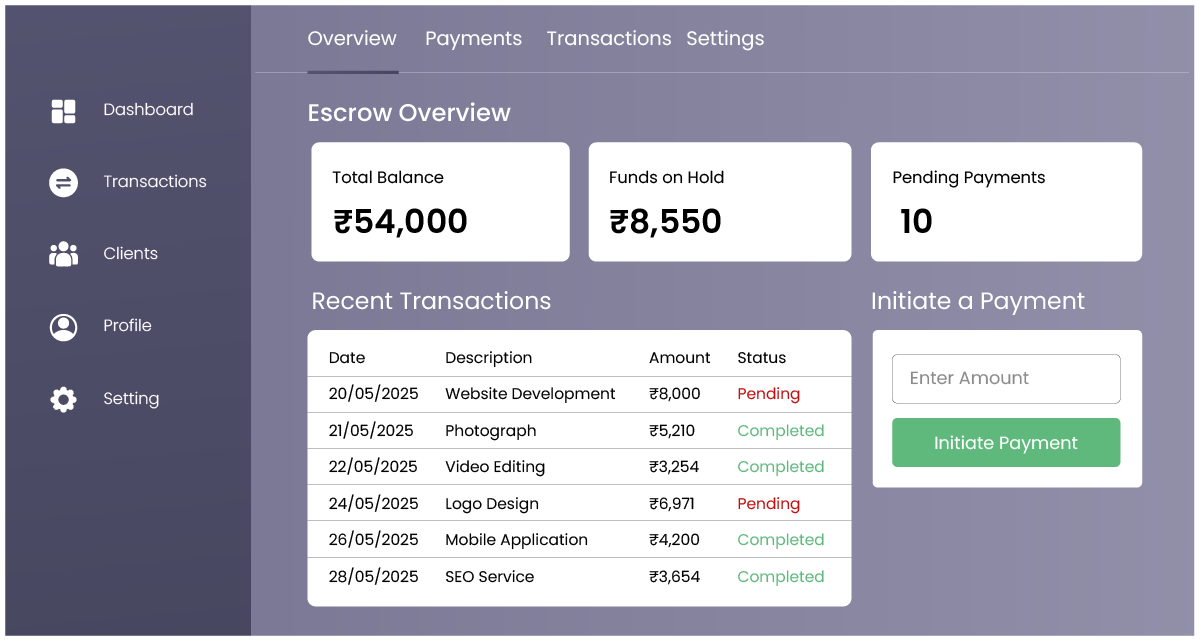

Tracking Money With Absolute Clarity

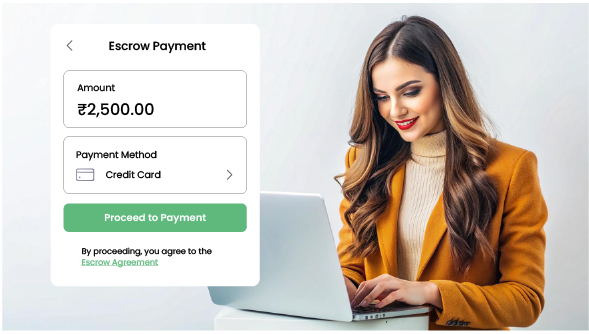

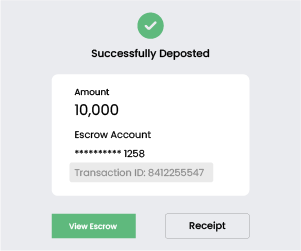

Safe Funds Locked Fast

Funds are securely deposited into escrow accounts instantly, ensuring neutral holding. Both parties gain confidence knowing money is safe, eliminating risks of fraud, premature release, or disputes.

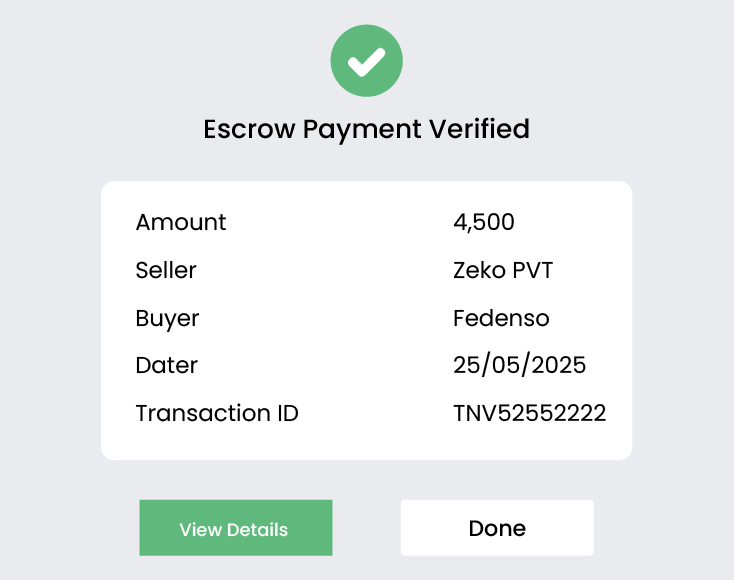

Validate Before Confirmation

Escrow validates every payment milestone against agreed terms. Buyers and sellers both receive real-time updates, ensuring complete compliance. This step guarantees accountability before any fund movement, reducing transactional errors.

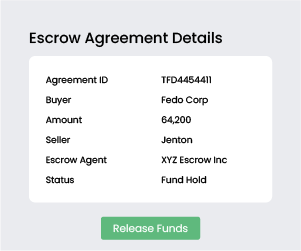

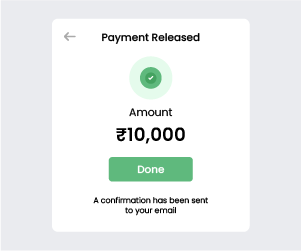

Funds Released With Assurance

Once obligations are verified, funds are released securely. Sellers receive guaranteed payments without delay, while buyers get assurance of services delivered. Transparency and trust define this final step.

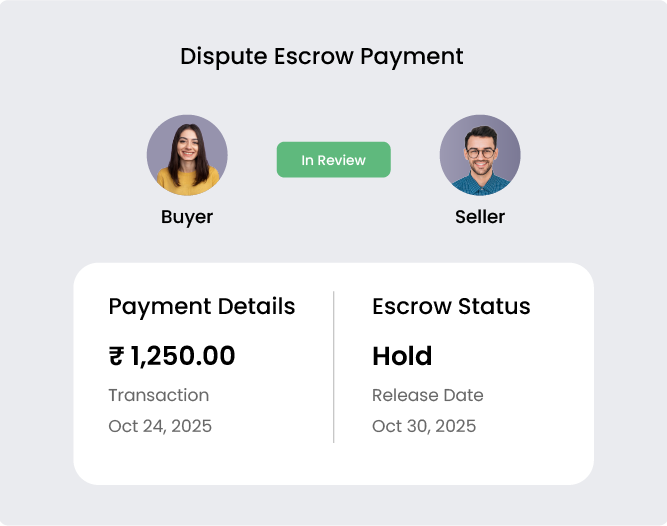

Resolving Conflicts With Trusted Escrow

Reliable Digital Payment Protection Guaranteed

Funds Secured

Payments remain safe until obligations are verified, ensuring secure financial management.

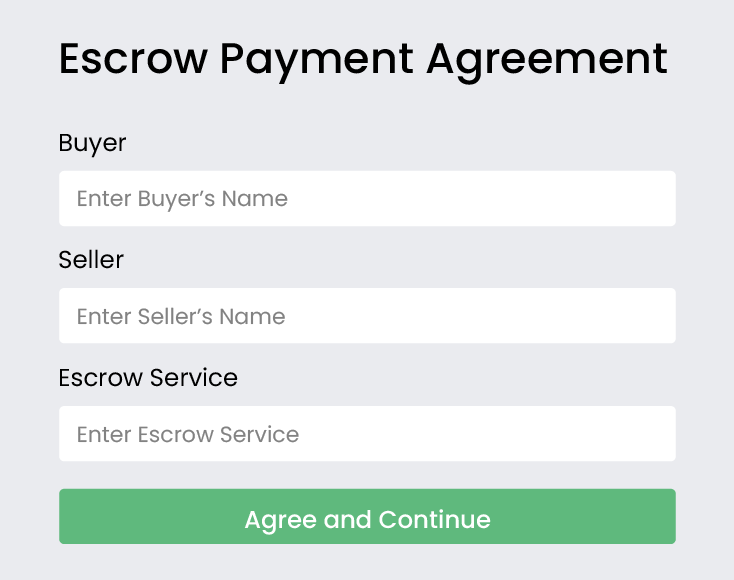

Neutral Oversight

Escrow acts as an impartial intermediary protecting both buyers and sellers.

Risk Control

Reduces fraud, errors, and disputes by ensuring transparent processes.

Compliance Assured

Adheres to regulatory standards, guaranteeing secure, trustworthy transactions.

Transparent Handling

Offers clear visibility of every step in the escrow process.

Domestic Reach

Supports domestic transactions safely, with verified and regulated payment management.